Cybersecurity Insurance Policies

Cybersecurity insurance is a type of insurance that protects companies from money losses caused by cyberattacks .It works like car insurance. Just as car insurance pays for damage after an accident, cyber insurance pays for losses after a cyberattack .The insurance company accepts the risk and promises to give money if loss or damage happens.

Types of Cyber Insurance Policies

There are two main types of cyber insurance policies.

The first one is first-party coverage. This pays for the company’s own losses, such as damaged systems or lost income.

The second one is third-party coverage. This pays for damages that affect other people, like customers or business partners.

Role of Managed Services

Managed services mean hiring outside experts to handle cybersecurity every day. These experts monitor systems, fix problems quickly, and reduce the chances of a cyberattack. Many small and medium businesses use managed services because they do not have strong IT teams inside their company.

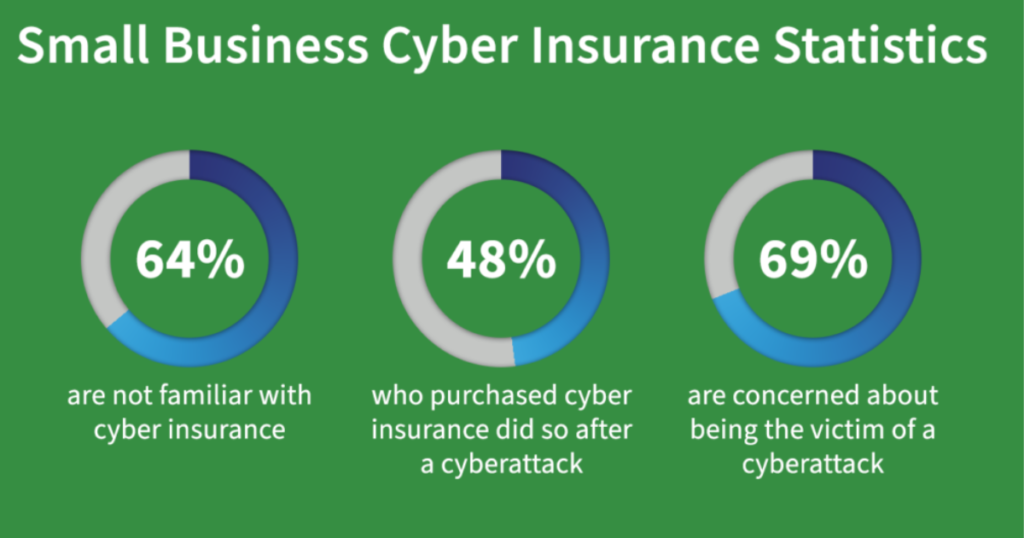

Cybersecurity Insurance Policy Insights for Small Businesses

Cyberattacks are growing every year, and no business is fully safe. Hackers often go after small and medium businesses because they usually have weaker security systems .Even one cyberattack can cause big money loss, and many small businesses cannot handle this cost on their own. Cybersecurity insurance is very helpful because it reduces the financial burden. It also helps businesses recover faster after an attack.

Cybersecurity Insurance for Remote Workforce Protection

Remote work became very common after the pandemic, but it also created new problems. Many employees face slow internet, weak devices, and security risks at home. Hackers take advantage of these issues and attack businesses more often.

During the pandemic, ransomware and phishing attacks increased very quickly, and remote workers were attacked five times more than before. Many companies were not ready, since their security plans were only made for office environments.

Cybersecurity insurance helps businesses handle these risks. It covers costs like system repair, legal fees, and customer support after an attack. This way, companies can recover faster and reduce stress when something goes wrong.

In short, remote work is here to stay, and cyber insurance gives businesses extra safety for both their workers and data.

Ransomware Protection Cybersecurity Insurance Coverage

When ransomware attacks happen, businesses can lose money and trust. Cybersecurity insurance helps by covering many important areas.

Business interruption: If a company’s systems go offline and work stops, insurance can pay for the lost income.

Threat response and fixing systems: Insurance may cover experts who repair systems, investigate the attack, and prevent more damage.

Legal expenses: If customers file lawsuits after a cyberattack, insurance can help pay for lawyers and court costs.

Data breach recovery: If hackers steal private data like credit card numbers, insurance covers costs of notifying customers and offering credit monitoring.

Regulatory action: In industries like healthcare or finance, companies may face investigations or fines. Insurance helps pay for these costs.

Reputation management: Businesses may need public relations support to rebuild trust. Insurance can help cover these expenses.

Ransom payments: Some policies cover ransom payments, but many insurers are reducing this coverage because ransom costs are very high.

Cybersecurity Insurance for Healthcare and Compliance

Healthcare is a big target for hackers. They often steal patient data or use ransomware. Even small mistakes, like lost laptops, can cost a lot. For many years, healthcare has had the highest cost of data breaches. Insurance for healthcare is hard to get and very expensive. Companies must follow strict security rules, but even then, prices keep rising because attacks are increasing.

Small hospitals and clinics are at higher risk because they have small budgets and old systems. Insurance companies may charge them more or even deny coverage.Even big hospitals with strong security pay high premiums, since patient data is very valuable to cybercriminals.

That’s why cyber insurance is very important for healthcare. It helps cover big costs, meet compliance rules, and recover after an attack.

Managed Cybersecurity Insurance Services for SMEs

Small businesses (SMEs) often cannot manage all cyber risks alone. Managed services give them experts who watch and protect their systems. Insurance then helps cover costs if an attack happens. Together, they reduce stress and save money for small businesses. This makes it easier for SMEs to stay safe and grow.

What is cybersecurity insurance?

It is insurance that helps a business pay for losses after a cyberattack, like data theft or ransomware.

Do small businesses need it?

Yes. Even small companies can be attacked, and insurance helps them recover faster.

What does it cover?

It can cover lost income, system repair, legal fees, and costs from stolen customer data.

Can it protect remote workers?

Yes. It helps cover attacks that happen to employees working from home

Conclusion

Cybersecurity insurance helps businesses stay safe from hackers and cyberattacks .Small businesses and SMEs can use insurance and expert services together for better protection .Healthcare companies also need it because patient data is very important. Having insurance and good security helps businesses recover faster and keep their data safe.